The risks associated with gas infrastructure investment have never been higher.

This report continues our series exploring the long-term risks associated with investment in power sector gas infrastructure globally. It follows on from our Put Gas on Standby report from last year which focused on the outlook for gas power plants in Europe and the US, with attention turning here to Asia and the extreme risks associated with nations in this region increasing their exposure to the highly volatile market for liquefied natural gas (LNG).

The Russia-Ukraine conflict has demonstrated that gas supplies can be weaponised or face international sanctions at any time and nations should now be urgently prioritising ways to reduce exposure to this highly volatile market.

This report attempts to persuade policymakers to grasp the immense opportunities presented to them in the clean energy sector and begin the journey to energy independence by planning for a power system centred around lower cost and lower risk renewables.

Key Findings:

- Increased exposure to the highly volatile global LNG market would be unwise. The Russia-Ukraine conflict has demonstrated that gas supplies can be weaponised or face international sanctions at any time, and shown clearer than ever that now is not the time for nations to be increasing their dependence on volatile gas markets for energy sector needs. Planning a power system centred around renewables with battery storage will minimise exposure to commodity price risk, can be developed at lower cost than new gas, and will prevent billions of dollars of LNG infrastructure investment from stranding.

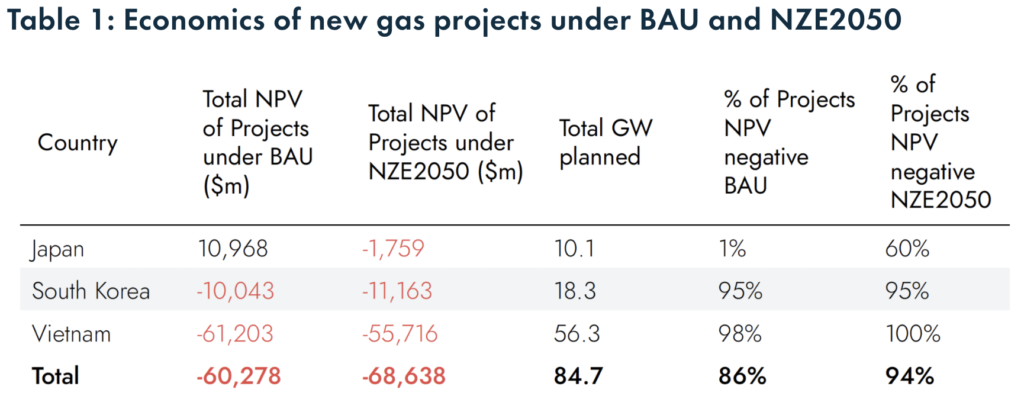

- New large-scale gas units in Japan, South Korea and Vietnam appear totally incompatible with a net zero emissions by 2050 pathway and any that are built may be forced to close well in advance of the end of planned lifetimes. Up to $70 billion could be lost if planned new gas units are developed under this more stringent climate scenario. The vast majority of projects would require extensive government backing to be made viable, the provision of which makes no sense when cheaper renewable alternatives are available.

- Opportunities for renewables in Japan, South Korea and Vietnam are vast and more cost-competitive than gas. New solar and onshore wind power developments in Japan, South Korea and Vietnam are either already cheaper, or will become cheaper overall investments than new gas units by 2025. Given typical planning and construction timeframes of at least four years for new gas, any units that move ahead to development could face constrained running hours from day one amid strong competition from lower cost renewables.

- Even new solar units with battery storage capacity will become cost-competitive with existing gas plant capacity in Japan and South Korea during the early 2030s. This means that these nations will have a low carbon energy source able to provide comparable flexibility services to a gas unit available at lower cost to the system within a decade, allowing policymakers to plan their phase-out of power sector gas use in line with their net zero emissions by 2050 targets. This inflection point could come even earlier in the event of upward swings in LNG prices.

- Offshore wind sector growth potential in Asia is huge. Large coastlines and territorial water areas mean that all three countries analysed here are extremely well-positioned to become world leaders in offshore wind development. Offshore wind capacity in South Korea and Vietnam will become cost competitive with new gas this decade.

***

Download the Full Report here.

***

This article “Stop Fuelling Uncertainty: Why Asia should avoid the LNG trap” is originally from Carbon Tracker.