“QUALITY CLIMATE CHAOS FOR YOU”

Read why MUFG must align its financing with the Paris Climate Agreement.

© Paul Hilton

MUFG, Japan’s largest bank, wants to “be the world’s most trusted financial group.”

The problem? They’re the largest Asian banker of fossil fuels and one of the largest bankers of deforestation, and they’re not telling anyone.

MUFG, ALIGN WITH 1.5°C!

© 123rf.com

$150 Billion – that’s the amount MUFG has bankrolled fossil fuels and deforestation-linked commodities since the Paris Climate Agreement.

© 123rf.com

© 123rf.com

© Jiri Rezac / Greenpeace

TAR SANDS: MUFG is the largest Asian funder of tar sands – the dirtiest oil in the world, and is a major backer of Enbridge’s new “Line 3” pipeline project that would run from Canada to the US through Indigenous land. If built, it would add annual carbon emissions equal to another 50 coal plants! (Source: RAN)

© Jiri Rezac / Greenpeace

PALM OIL: MUFG is one of the biggest financiers of Conflict Palm Oil – the leading destroyer of Southeast Asian rainforests and peatlands – with catastrophic consequences for the climate, biodiversity and local Indigenous communities. MUFG financing is linked to the forests fires that have made Indonesia one of the world’s largest greenhouse gas emitters. (Source: Forests&Finance)

© RAN

© RAN

MUFG cannot be trusted with our future because they are…

1

Destroying the planet

MUFG’s financing of fossil fuels, deforestation and fires is accelerating the climate crisis AND the extinction crisis.

2

Harming lives

MUFG’s financing is threatening the livelihoods of Indigenous and frontline communities.

3

Breaking promises

MUFG signed the UN Principles for Responsible Banking, but has no plan to stop their financing of climate chaos, deforestation, and rights abuses.

© “UK BOE MARK CARNEY” by Bank of England is licensed under CC BY-ND 2.0

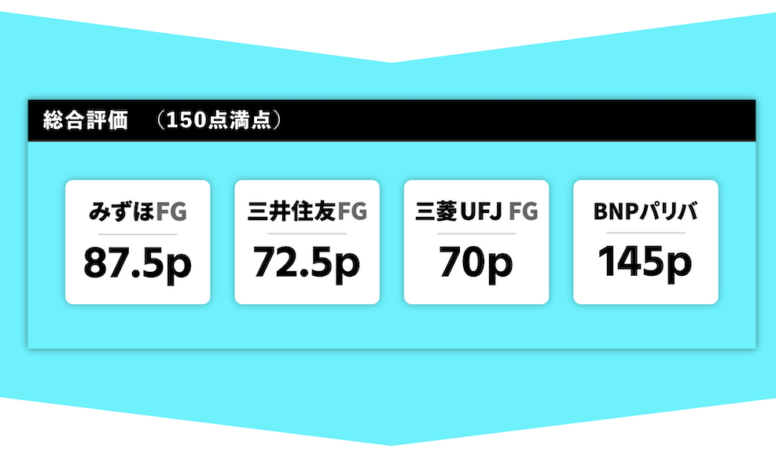

What are other banks doing?

Dozens of major banks, including JPMorgan Chase, have already committed to align their financing with Paris or achieve net zero financed emissions. And over 100 financial institutions, with over $21 trillion in total assets, have committed to disclose their financed emissions.

“Companies and industries that are not moving towards zero-carbon emissions will be punished by investors and go bankrupt.”

© “UK BOE MARK CARNEY” by Bank of England is licensed under CC BY-ND 2.0

MUFG: Harming Lives

The new “Line 3” tar sands pipeline financed by MUFG is being built through untouched wetlands and the treaty territory of Anishinaabe peoples in Minnesota. “Allowing the Line 3 Pipeline to move forward, despite years of opposition from native communities, is nothing short of a betrayal of treaty rights and an assault on Indigenous sovereignty.” ~Indigenous opposition leader

Read more

© RAN

© RAN

© RAN

Over a decade, the community of Pante Cermin in Aceh, Indonesia, have resisted land grabbing and use of military force to silence opposition against palm oil development. The buyers of this conflict palm oil included palm oil giant Sinar Mas, heavily funded by MUFG. This is just one of many instances that MUFG finances conflict palm oil with hundreds of millions of dollars.

Read more

© RAN

![IMG_0821[1] IMG_0821[1]](https://fossilfreejapan.org/wp-content/uploads/2021/03/IMG_08211-776x459.jpg)

Share to spread the word