Market Forces

Kiko Network

350 org. Japan

FoE Japan

Rainforest Action Network

Wednesday 29 June 2022: Japanese corporations have faced a record number of shareholders backing proposals calling for greater action and transparency on meeting net-zero carbon emissions targets.

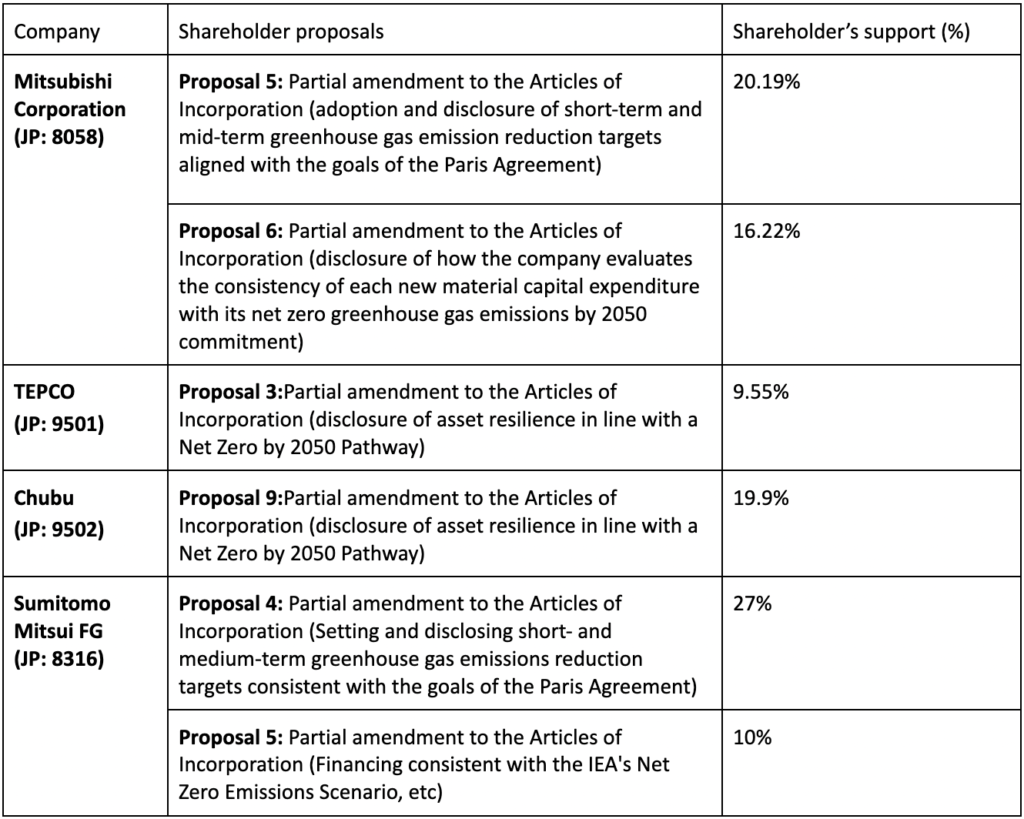

Today, and over the past week, shareholders representing $22 billion USD (3 trillion yen) investment in these corporations have put four of Japan’s largest companies in the spotlight on climate-risk management – Mitsubishi Corporation, Sumitomo Mitsui Financial Group (SMBC Group), and two utilities Tokyo Electric Power Company Holdings (TEPCO) and Chubu Electric Power Co who jointly own JERA, the largest thermal power generator in Japan.

The shareholders include civil society organisations or their representatives, including 350.org Japan, Friends of the Earth Japan, Kiko Network, Market Forces and Rainforest Action Network.

The votes demonstrate that the tide has turned for companies failing to align their business practices with the growing risks due to the climate crisis. There is a strong momentum of institutional investors and shareholders who are demanding action to counter these grave threats.

Mitsubishi Corporation

“With its significant investments in the polluting and risky LNG sector, Mitsubishi Corporation has been betting shareholder capital against the clean energy transition it claims to support. On proposals 5 and 6, investors representing 1.2 trillion and 960 billion yen investments respectively, have made a clear directive to Mitsubishi that before the company moves forward with any new LNG plans, the company must justify those plans to demonstrate that they are in line with their net zero by 2050 commitment,” said Megu Fukuzawa, Energy Finance Campaigner, Market Forces.

“Mitsubishi has a net-zero by 2050 commitment, but its pathway to reach this commitment is unclear. Although our engagement resulted in a better understanding of their gaps and concrete measures needed, the company needs to act more urgently to manage climate risk. The climate crisis affects society as a whole, including companies. We will continue to push companies to change their policies and their business plans through various means including engagement,” said Ayumi Fukakusa, Campaigner, Friends of the Earth Japan.

Chubu Electric

“JERA’s plans to expand coal and LNG pose unacceptable risks to Chubu’s shareholders. They risk exposing Chubu to stranded fossil fuel assets as the world moves to align with climate goals. It comes as no surprise that a fifth of Chubu investors have voted to demand clear disclosure from Chubu to better understand the extent of climate-related financial risks posed by investing in JERA and its rampant fossil fuel expansion,” said Dr. Sachiko Suzuki, Climate and Energy Researcher, Market Forces.

“We have been discussing with Chubu Electric Power, however, our impression is there is a gap in understanding about the urgency of the climate crisis. At its AGM, Chubu Electric insisted the company would focus on stable electricity supply and following governmental policy. The company’s plan to use hydrogen and ammonia for thermal power generation as a ‘zero emission power’ is not commercially viable at this moment. We hope that the favourable percentage of votes for our proposals to Chubu Electric and TEPCO requesting the strengthening of the company’s decarbonisation strategy (as well as the 26%, 18%, and 19% in favour (respectively) of the J-POWER proposals), would positively impact the business operations of both Chubu, TEPCO and JERA.” said Yasuko Suzuki, Program Coordinator, Kiko Network.

TEPCO

“Today’s vote is a rebuke from shareholders against TEPCO’s investments in a company like JERA, which is aggressively developing new coal and gas power stations, and new gas fields and infrastructure, out of line with a net-zero emissions by 2050 pathway. This vote is even more powerful in light of the significant government holding in TEPCO, as a greater proportion of institutional investors voted for the proposal,” said Dr. Sachiko Suzuki, Climate and Energy Researcher, Market Forces.

“JERA, in which TEPCO and Chuden each hold a 50% stake, is the largest thermal power producer in Japan. JERA is constructing huge coal-fired power plants without emission reduction measures in Yokosuka City, Kanagawa Prefecture, and Taketoyo-cho, and Aichi Prefecture, against the global trend away from coal,” said Takako Momoi, Manager of Tokyo Office, Kiko Network.

“Although the company insists that it is aiming to achieve net-zero (emissions), it keeps investing in hydrogen/ammonia co-firing and CCUS technology, which are not available for practical use yet, and preserving its thermal power generation facilities for the future. It is a risk that could lead to stranded assets of future thermal power plants, to the enormous detriment of shareholders,” said Takako Momoi.

“In particular, TEPCO’s largest shareholder is the Nuclear Damage Compensation and Decommissioning Facilitation Corporation (NDF) which owns 54.74% of the company. It can be said this company is effectively nationalised. Our proposal received approximately 9.55% approval from shareholders. However, taking into account the 54.74% owned by the government, the real approval rate of our resolution is 21.1%. This indicates that the importance of financial disclosure of climate risks is recognized. TEPCO, Chubu and the Japanese government should recognize that it is their responsibility to disclose climate related financial risks of their investments in JERA, which is the largest energy company in Japan,” said Ms Momoi.

Sumitomo Mitsui Financial Group

“Proposal 4 received a higher supporting rate than the 23% of last year’s MUFG (Mitsubishi UFJ Financial Group) with the same objective. This is in the context of 6 recommendations issued by two major proxy advisory firms, all but one of which recommended against our proposals, while fossil fuel prices continue to soar due to the war in Ukraine and the energy crisis. This result sends a strong message to the Board of Directors that investors believe SMBC Group’s current efforts to achieve net-zero are inadequate and should accelerate its actions.” said Eri Watanabe, Senior Finance Campaigner, 350.org Japan.

“Proposal 5, (an entirely new proposal), received the same level of support as similar proposals made this AGM season to financial institutions in Europe and the United States. SMBC Group needs to respond to the investors’ voice by strengthening its climate-related risk management through setting business plans with short and mid-term targets and phasing out fossil fuel financing, starting from the controversial East African Crude Oil Pipeline.” said Watanabe.

“27% of the shareholders of SMBC Group are concerned that the company has failed to demonstrate management of climate risk. This means that shareholders with an investment of 1.5 trillion Yen are concerned that SMBC’s claims of support for net-zero by 2050 and the Paris Agreement are hollow, without concrete action that shows that their business plans are shifting away from the fossil fuel industry. This is a strong wake up call to SMBC and its board of directors, as well as the other Japanese megabanks,” said Dr. Sachiko Suzuki, Climate and Energy Researcher, Market Forces.

Toyoyuki Kawakami, Japan Representative, Rainforest Action Network said:

“At the shareholders meeting, CEO Jun Ohta emphasised the importance of the forest sector, and stated that the emissions from the highest emitting sectors will be calculated as needed. However, SMBC’s 2030 GHG emission reduction target for the electricity sector does not include emissions from the forest sector, such as woody biomass generation or coal co-firing. This leaves emissions from fuel combustion nowhere to be counted, leading to a false transition financing to decarbonization. SMBC should review the emissions calculation for the electricity sector. At the same time, SMBC should urgently calculate emissions from the forest and agribusiness sector, and develop its short and medium term emission reduction targets.”

Background for editors:

Record numbers of climate-related shareholder proposals in 2022

The coalition of climate groups (Market Forces, Kiko Network as organisations and individuals from 350 org. Japan, FoE Japan, and Rainforest Action Network) have lodged six shareholder proposals in total to four Japanese companies this year. Although six itself is the largest number thus far, there have been more climate-related proposals filed by other groups including institutional investors this season.

Effects of shareholder proposals

Market Forces filed a shareholder proposal with Sumitomo Corporation last year. In the aftermath of that proposal achieving a 20% vote in favour, Sumitomo Corporation made improvements to their coal policy and announced their withdrawal from the Matarbari 2 coal power station in Bangladesh in February 2022.

350.org Japan, RAN, Kiko Network and Market Forces filed a shareholder proposal to Mitsubishi UFJ Financial Group (MUFG) last year. After resolution was filed, MUFG announced a portfolio-wide net-zero goal by 2050 and became the first bank to join the Net Zero Banking Alliance. Mizuho Financial Group and SMBC Group followed suit after that.

In 2020, Kiko Network filed a shareholder proposal to Mizuho FG and Mizuho became the first bank in Japan to set a coal phase-out target by 2050 (later changed to 2040). The other two megabanks, MUFG and SMBC Group followed this move.

The companies subject to shareholder proposals have also made improvements in disclosure thus far, and the expectation is that more will be made once their integrated reports are released later this year.

***

NotesRelated documents:

Mitsubishi Shareholder Proposal (JP/EN)

Mitsubishi Investor Briefing (EN)

Mitsubishi Investor Briefing (JP)

Mitsubishi Investor Update (EN) May 2022

Mitsubishi Investor Update (JP) May 2022

Chubu Shareholder Proposal (JP/EN)

TEPCO Shareholder Proposal (JP/EN)

TEPCO/Chubu Investor Briefing (EN)

TEPCO/Chubu Investor Briefing (JP)

TEPCO/Chubu Investor Update (EN) May 2022

TEPCO/Chubu Investor Update (JP) May 2022

SMBC Group Shareholder Proposal (JP/EN)

SMBC Group Investor Briefing (EN)

SMBC Group Investor Briefing (JP)

SMBC Group Investor Update (EN) May 2022

SMBC Group Investor Update (JP) May 2022

***

Contact:

Market Forces www.marketforces.org.au

Sachiko Suzuki, E-mail: sachiko.suzuki[@]marketforces.org.au

Mugumi Fukuzawa, E-mail: megu.fukuzawa[@]marketforces.org.au

350.org Japan https://world.350.org/ja/, https://350.org/

Eri Watanabe, E-mail: japan[@]350.org

FoE Japan https://www.foejapan.org/

Ayumi Fukakusa, E-mail: fukakusa[@]foejapan.org

Rainforest Action Network (RAN) japan.ran.org

Yuki Sekimoto, E-mail: yuki.sekimoto[@]ran.org

Kiko Network www.kikonet.org

Contact: Yasuko Suzuki, E-mail: suzuki[@]kikonet.org